Is it deductible? Tax Report column explaining changes to interest deductibility of home-equity loans.The Federal Trade Commission’s explainer on home-equity products.

One consideration with this option is that if you currently have a low mortgage rate, you may have to trade it in for a higher rate in order to pull the cash out. This involves refinancing your current mortgage but adding to the balance of the loan to give yourself some spending money.įor example, if you have $200,000 left on your mortgage and you want to pull $50,000 out, you can refinance into a $250,000 loan. If you want to pull equity out of your home but don’t want to get a second loan, another option is a cash-out refinance. Are there other types of home-equity products? As with a home-equity loan, make sure you understand the fees and read the fine print. Make sure you understand how the rate might increase over time. If you don’t repay the loan, you could lose your home.īecause HELOC rates are variable, they often start lower than home-equity loan rates but can rise along with going interest rates. One major difference between a HELOC and a credit card is that the HELOC is secured by the home itself.

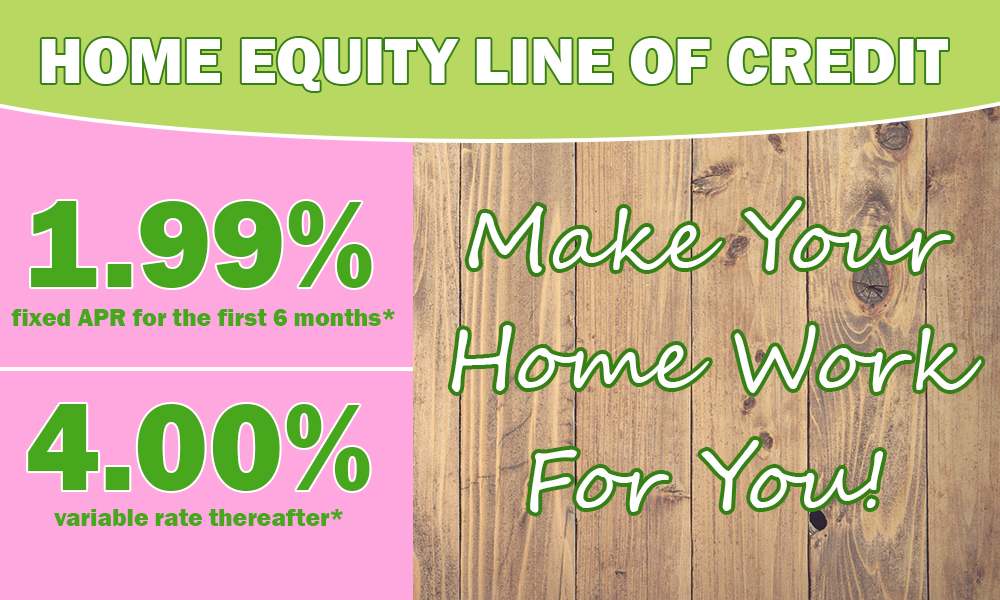

You don’t have to max out the credit line, but you have the option to, and then you pay back what you have spent with interest. It comes with a credit limit tied to the amount of equity you have built up. Mortgage professionals say that a home-equity loan might be the best option if you have a large one-time expense while a HELOC might be more beneficial if you expect to have multiple or recurring expenses.Ī HELOC can be a bit more complicated than a home-equity loan. You don’t receive a set amount, but instead get a checkbook or credit card to spend money as you need it. While a home-equity loan looks a lot like a standard mortgage, a home-equity line of credit looks more like a credit card. How is a home-equity loan different from a home-equity line of credit (HELOC)? But read the cancellation options carefully before you agree to the loan. Under these circumstances, you don’t owe any fees. But if you’re taking out a home-equity loan secured by a house you already own, you can only deduct the interest if you use the cash for renovations or substantial improvements.įederal consumer protections generally allow you to cancel the loan within three days of signing up for it if you change your mind about borrowing the money. Most people assume that mortgage interest is tax deductible. When thinking about the total costs, consider the principal amount you must repay and the interest cost, as well as other fees. It generally pays to shop around to try to get the best rate and all-in cost. You don’t have to go with the same company that handles your mortgage. What you should know before taking out a home-equity loan Additionally, the more you borrow against your home, the greater the chances are that you end up owing more than the property is worth if home prices fall like they did during the financial crisis of 2008.

If you stop making payments, you risk losing your home. But the lender may only let you pull $40,000 of it out through a home-equity loan. For example, if you owe $200,000 on the mortgage and the home is valued at $300,000, you have $100,000 in equity.

0 kommentar(er)

0 kommentar(er)